Security and Compliance - Safeguarding Your Transactions

At Bluetrino, our security

The privacy and security of personal data is our top priority. We apply industry best practices throughout the platform. Only encrypted channels are used for data transfers, and all data storage is protected by industry-leading firewalls.

Our KYC and AML Process

We have partnered up with Sum and Substance to provide KYC and AML compliance, we also employ AVR and CDV on all South African bank accounts to make sure we know who we are working with.

FICA Compliance

The Financial Intelligence Centre Act (FICA), which went into effect in 2001, and the Prevention of Organized Crime Act (POCA), which came into force in 1998, form the basis for fighting money laundering in South Africa. The Financial Intelligence Center (FIC) was established in 2001. South Africa's Financial Intelligence Center conducts audits and controls to prevent money laundering.

South Africa is a member of FATF and became compliant with the global standards set by FATF with the amendments made in AML laws in May 2017. With the amendment of AML laws, AML requirements for financial institutions have changed significantly. With the revision of FICA, Customer Due Diligence requirements have been established for financial institutions. In line with the customer due diligence requirements, the following transactions have become mandatory for financial institutions.

- Identifying and verifying the client

- Determination of customer risk level

- Keeping customer information up to date

- Recording customer information

Bluetrino hereby reports that it is a mandatory company policy to ensure KYC and FICA Policies are in place to ensure AML measures are effective and well maintained to avoid the possibility of Money Laundering.

Key individuals for Bluetrino (namely, Gregor Peter Josef Schmitz and Chad Faurie) have attained certificates in FICA Awareness through Moonstone Business School which covers Anti Money Laundering in depth. Bluetrino will also ensure on-going measures and training for staff is being conducted in this regard. (Certificates can be made available on request)

Clients of Bluetrino will always be expected to provide updated FICA Documentation on request in order to ensure FICA and AML Compliance and to assist in the detection, prevention and deterrence of money laundering.

“Know Your Client” (KYC) Requirements

Details of the KYC information and documentation requirements are listed below; however please note that these are the minimum requirements and, in certain circumstances, additional information and/or documentation may be requested

Please note that all documentation provided must be either:

- An original, or

- A copy of the original document certified by an independent Commissioner of Oaths (Note: Certification must contain the full name, title and signature of the Commissioner of Oaths and wording should stipulate "Certified a true copy of". Where the document being commissioned is more than one page, the stamp/full commission must appear on either the front or back page and the Commissioner must initial every page of the document in between.)

In addition, KYC information should be updated on a regular basis to ensure client information remains accurate and up-to-date as well as to align to any changes in legislative and/or global industry standards

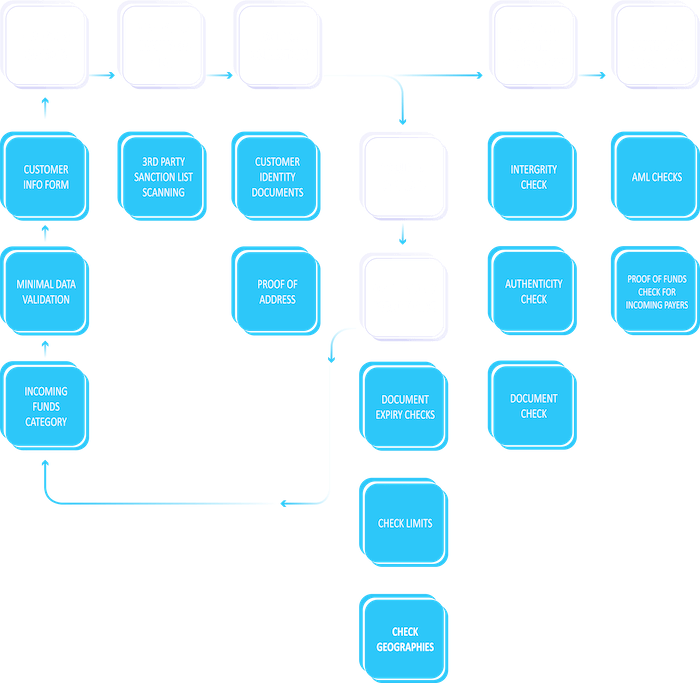

Bluetrino makes use of Sum and Substance to assist in our KYC Process and AML Screening by means of a KYC Verification process, highlighting but not limited to the following

- Selfie Based Checks

- Liveness

- ID Document Verification and Validation

- Proof of Residence Document Verification and Validation

Sanctions and Watchlists

Sanctions and Watchlists: Quick identification of persons associated with criminal activity or those who are prohibited from certain industries and activities.

- Thousands of fitness and probity, global and national sanctions lists: OFAC, HMT, UN, and many more

- PEP Profiles: Automated monitoring of potentially concerning information that the media gives you access to

- Bluetrino is committed to protecting your personal information after we collect and store it.

All information is encrypted in transit and at rest. - We may use the information we collect, including your personal information in order to:

Confirm to our clients that you are who you say you are, in case of background checks;

Confirm to our clients the authenticity of information contained in your identification documents, in case of document integrity check

Licensing

Bluetrino operates with legal entities in Lithuania and South Africa in order to provide a complete bouquet of services to our customers around the world.

UAB Bluetrino LT is a duly registered Company in Lithuania: Registration Number 306121218.

UAB Bluetrino LT is a licensed Crypto currency exchange operator and Crypto currency depository wallet operator.

Bluetrino SA (PTY) Ltd is a limited liability company registered in South Africa. Registration number 2014/096242/07

Bluetrino SA (PTY) Ltd is an authorized Financial Services Provider (FSP - 27056) regulated by the Financial Services Board (FSB).

Licenses include: "Advice Non-automated" and "Intermediary Other" for Long-Term and Short-Term Deposits.